Thinking of Selling? Discover the value of your home

NOOSA PROPERTY MARKET REPORT

Year 2025 in Review

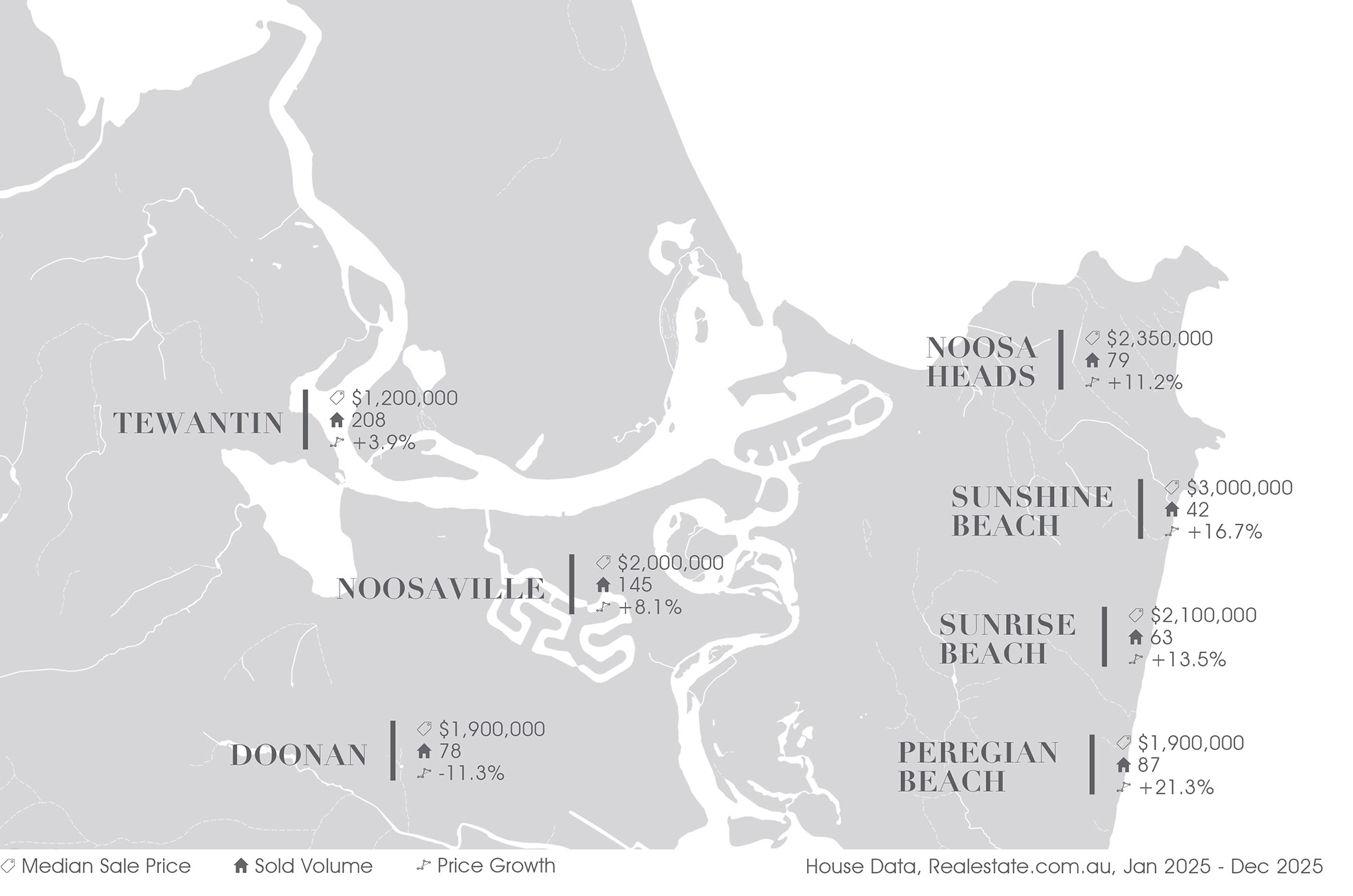

As 2025 drew to a close, the Noosa property market has delivered a year of resilience, selective strength and measurable divergence across our local suburbs. Coastal precincts, led by Noosa Heads, Sunrise Beach and Peregian Beach have outperformed the broader Sunshine Coast and national averages, with double-digit price growth and robust sales volumes. The hinterland and peripheral areas have recorded more modest but steady gains, reflecting a market that continues to reward location, character and supply scarcity above all else.

Monetary Policy and the Rate-Cut Effect

The Reserve Bank of Australia delivered three 25-basis-point rate cuts across 2025, reducing the cash rate from 4.35% to 3.60% and then holding steady into year’s end. This earlier-than-expected easing cycle fundamentally reshaped buyer psychology and serviceability metrics across the Australian housing market, with first-home buyers and upgraders re-engaging as borrowing capacity improved and rate-cut expectations became front of mind. The Westpac Housing Pulse in late 2025 highlighted that the national “time to buy” index had pushed to a cycle high, signalling that sidelined buyers were moving back towards active intent. The cumulative effect was a high single-digit rise in national dwelling prices over calendar 2025, with further gains expected in 2026 as lower rates continue to filter through refinancing, equity release and new lending channels.

Consumer Sentiment and Price Expectations

Despite persistent cost-of-living pressures, Australian consumer sentiment on housing shifted materially across 2025. The Westpac-Melbourne Institute house price expectations index reached a new cycle high of 172.4 in November 2025, with over 80% of consumers expecting residential prices to rise over the next 12 months. This is particularly pronounced in Queensland, where intergenerational wealth transfer, interstate migration and established demand fundamentals have anchored optimism. Critically, this optimism has been selective. While the time-to-buy index has improved, the “time to sell” index remains compressed, meaning vendors are not yet convinced they should exit, and buyers remain wary of overpaying. This creates a market where winners are those with clarity, flexibility and insider knowledge of value.

The Coastal Outperformance Story

Noosa’s coastal precincts delivered strong absolute and relative performance across 2025. Noosa Heads, Sunrise Beach and Peregian Beach, our genuine premium precincts, averaged price growth of 15.3% for the year, well above the national average of 6-8% and significantly ahead of the broader Sunshine Coast.

- Peregian’s acceleration: Peregian Beach’s 21.3% growth stands out as the strongest performer in the Noosa cohort. This reflects growing recognition that genuinely beachfront and walkable precincts are increasingly scarce, coupled with strong buyer migration from Sydney and Melbourne seeking value relative to comparable properties in those capitals.

- Noosaville’s steady hand: Despite recording “only” 8.1% growth, Noosaville remains the volume driver with 145 sales, indicating a healthy market for waterfront and near-waterfront homes in the $1.8m-$2.2m band. This is the market where lifestyle buyers and upgraders are most active.

- Tewantin’s moderation: Tewantin’s +3.9% growth reflects a market for more affordable entry-level and mid-range properties, serving owner occupiers and investors in the $900k-$1.4m range. Sales volume (208) remains robust, suggesting solid underlying demand.

- Doonan’s contraction: Doonan’s -11.3% decline warrants attention. It reflects a rotation in buyer preference away from larger acreage and rural-lifestyle properties toward high-density, walkable, beachside precincts. This is a trend we have observed across rural lifestyle markets nationally as buyers prioritize convenience and access over land size and privacy.

Global and National Prestige Performance

Despite economic headwinds, the ultra-luxury residential market remained resilient through 2024-2025. Knight Frank’s Wealth Report 2025 highlights generally positive outcomes across Australia’s leading coastal markets, with lifestyle destinations outperforming capital city cores.

In Australia’s prestige segment (top 1-2%), Brisbane and South-East Queensland ranked among the strongest performers, recording annual growth of approximately 8-15%. Lifestyle markets such as Noosa and the Gold Coast captured a disproportionate share of this growth, driven by interstate migration, relative value compared to Sydney, and demand for established coastal living. By contrast, comparable global markets including Miami, Los Angeles and parts of the UK Riviera recorded more modest growth (2-6%), reinforcing Australia’s competitive value position.

For Noosa, this global context is critical. Domestically, it sits alongside Byron Bay, the Mornington Peninsula and the Gold Coast; internationally, it compares with tightly held coastal lifestyle markets such as Miami Beach and the Amalfi Coast – yet remains materially more affordable on a per-square-metre basis. This value asymmetry continues to attract capital.

The Queensland Buyer – A Shift in Dynamics

While often assumed to be driven by Sydney and Melbourne buyers, Queensland-based capital dominated Noosa’s prestige market in 2025. The most decisive purchases came from Brisbane buyers and existing Noosa owners trading up.

A defining transaction was the sale of 29 Cooran Court, Noosa Heads, one of Queensland’s highest residential sales of the year, acquired by a Brisbane buyer in the high-$20m range. Sales across the $6m-$30m bracket reflect a consistent theme: a mature, confident local high-net-worth cohort securing irreplaceable assets with long-term hold strategies in a supply-constrained market.

Long Term Outlook

A Window of Opportunity – Mid-2026

For both buyers and sellers, 2026 presents a window of opportunity: rates are supportive, sentiment is positive, and supply remains constrained. For vendors holding premium stock, the next 12-18 months may represent the optimal time to bring properties to market before any potential rate-hike cycle compresses buyer appetite. For buyers committed to acquiring in Noosa, the current depth of available stock and vendor willingness to negotiate represents fair value relative to the 2021-2022 peak.

The Planning and Governance Context – Navigating the Transition

Over the past four decades, Noosa’s planning settings have been heavily shaped by a conservation-first philosophy that has been remarkably successful in preserving the shire’s low-rise character, environmental assets and sense of village scale. That legacy is a core reason why demand for quality housing here remains so deep and values so resilient.

At the same time, the same framework has made it difficult to deliver missing-middle housing, key-worker accommodation and enabling infrastructure at the pace required, which is now a central pressure point for businesses, health services and the broader labor market.

As the community leans into the next decade, the emerging challenge is less about “stopping” growth and more about how Noosa uses its UNESCO Biosphere Reserve status as a positive tool to balance environmental stewardship with a liveable, well-housed, well-connected community. The Economic Development Strategy 2021-2030, adopted by council, explicitly calls for integrated housing, transport and economic diversification outcomes; the conversation now is how to operationalise that agenda within the planning framework.

For property investors and buyers, this transition is material: it suggests that future developments enabling workforce housing, mixed-use precincts and transit-oriented nodes may move from being “contentious” to being “strategically endorsed”, which could materially shift the velocity and success rate of new projects in the $500k-$1.5m band over 2026-2028.

Macroeconomic Headwinds and Tailwinds

More recently, a surprise uptick in underlying inflation has shifted the market narrative from a prolonged pause to renewed speculation about further tightening. The latest read on core inflation has led all four major banks to forecast a 0.25 percentage point hike at the next Reserve Bank meeting, which would begin to reverse part of last year’s easing and re-introduce rate-rise anxiety into borrower calculations. For housing, this creates a more nuanced backdrop: structural supports such as chronic undersupply, strong migration and accumulated equity remain intact, but buyers are increasingly conscious that funding costs may edge higher again in the near term. In practice, that is likely to keep quality, scarcity-value assets (such as prime Noosa property) well supported, while re-introducing some price discipline and longer decision cycles in more marginal or highly leveraged segments of the market.

Noosa-Specific Outlook – 2026

For Noosa specifically, we anticipate:

- Noosaville stabilisation: The broader waterfront precinct should see steady activity, with prices likely to consolidate rather than surge as the market reprices from the 2025 uptick.

- Tewantin and secondary market maturation: As the missing-middle housing narrative gains traction and planning approvals accelerate, we may see renewed investor and owner-occupier interest in the $1.5m-$2.0m range, supporting growth in the +5% to +8% band.

- Doonan and rural lifestyle re-evaluation: Acreage markets are likely to remain under pressure as lifestyle preferences continue to shift toward walkability, convenience and beachside living. This creates an opportunity for agents and buyers to acquire established rural properties at fair value and, over time, explore their highest and best use.

- Prestige market momentum: The ultra-prestige segment ($6m+) should remain resilient, driven by Queensland capital, long-term hold strategy and structural supply scarcity. Buyer inquiry from Asia-Pacific and North America may accelerate if the Australian dollar remains competitive, but the dominant dynamic remains local high-net-worth acquisition of irreplaceable assets.