Thinking of Selling? Discover the value of your home

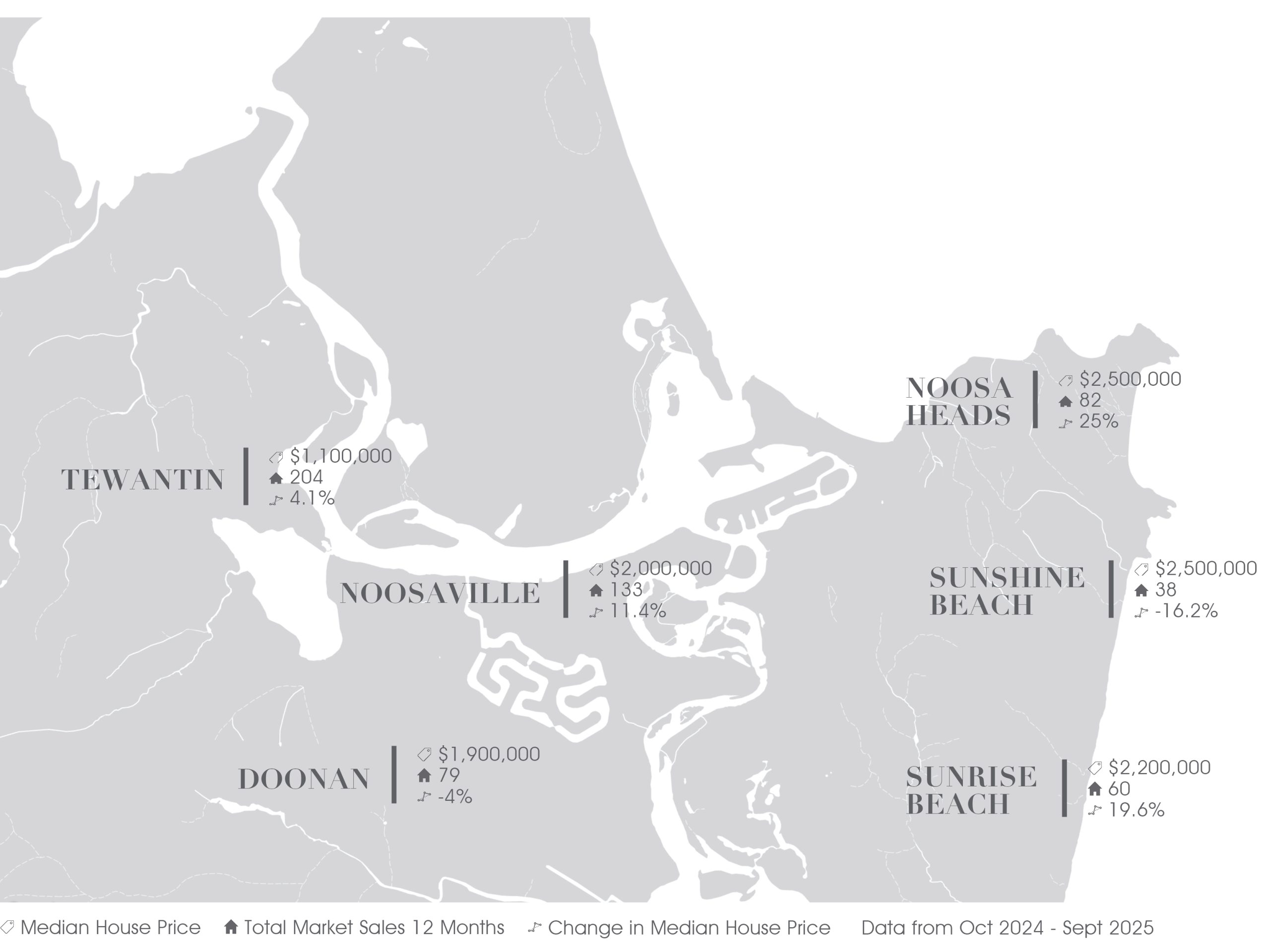

NOOSA PROPERTY MARKET UPDATE

3rd Quarter 2025

The past few months have brought significant developments in monetary policy, housing affordability measures, and local planning changes that will shape our market in both the short and long term.

The RBA has delivered three rate cuts this year, providing some relief to borrowers after the extended period of high rates. The economy is showing clear signs of recovery that began late last year, with strong consumer spending and business confidence indicators pointing upward.

“What does this mean for Noosa’s luxury market?” While the rate cuts have stimulated buyer activity across Australia, I’m observing a more nuanced response in our premium segment. Confidence has been clearly demonstrated in the top of the market, though prestige growth has curtailed ever so slightly. Results are fair and stable, and the demand-supply relationship seems well-balanced.

What’s particularly interesting is the return of confidence and the sense of FOMO (fear of missing out) in the mid-range of $4-7M properties. We’ve seen a series of waterfront and hinterland sales exceeding expectations in recent months, indicating strong buyer appetite in this segment.

The conversation among economists is now shifting to when a rate hike might be necessary, with some forecasting a potential increase as early as mid-2026. This creates a window of opportunity for both buyers and sellers in our market over the next 6-12 months, especially in those premium mid-range properties where momentum is building. The RBA’s focus remains firmly on keeping inflation within their target range long-term. With productivity growth constraints limiting Australia’s economic “speed limit” to around 2% before triggering inflation, we’re approaching a delicate balance. For luxury property owners, this reinforces the value of tangible assets as inflation hedges, particularly in supply-constrained markets like Noosa.

Housing Affordability and Market Momentum

Recent data from Cotality/CorLogic revealed that housing affordability reached record lows at the end of last year, with dwelling value-to-income ratios, mortgage serviceability costs, and deposit saving timeframes all at historic highs despite the subsequent rate cuts. The broader Australian market is showing strong momentum indicators, with auction clearance rates at their highest in well over a year and price expectations reaching 15-year highs according to Westpac surveys. Historically, house prices typically rise by double digits in the two years following the first rate cut, supporting a strong outlook for the near term.

For Noosa specifically, this national momentum combines with our persistent structural supply constraints. Construction levels remain down across Australia and aren’t expected to recover soon, with the National Housing Supply and Affordability Council projecting a worsening shortage of approximately 79,000 dwellings over the next five years, adding to an existing shortage of 200,000-300,000.

Noosa’s Unique Position: Planning Changes and Local Impacts

The recently adopted Amendment to the Noosa Plan has significant implications for our property market. The amendment passed by a narrow 4:3 council vote. The key themes against the changes raised concerns that while the goals of housing choice and affordability are worthy, some provisions in the Medium Density Residential Zone will not deliver the intended outcomes.

The new rules restrict dwelling houses to lots under 500m², cap secondary dwellings at 65m², limit dual occupancies to lots under 600m², and eliminate the dual occupancy option for lots 600m² or larger, pushing toward multiple dwellings instead. This removes the middle ground that many families prefer and makes Noosa an outlier in Queensland planning policy.

Luxury Market Implications and Opportunities

For our clients, these market conditions create both challenges and opportunities:

- Strong price growth is likely to continue, particularly in the luxury segment where supply remains extremely limited.

- The combination of rate cuts, strong market momentum, and Noosa’s enduring appeal as a premium lifestyle destination supports continued value appreciation.

- Brisbane’s property values have increased over 90% in five years, making it the second most expensive market after Sydney, which has implications for Noosa as a connected luxury market.

- The structural housing shortage and Noosa’s strict planning controls provide some insulation against severe corrections, this has been demonstrated post covid.

Looking Forward

Despite current economic uncertainties and local planning constraints, I remain optimistic about Noosa’s luxury property market. Our region’s natural advantages, limited supply, and enduring appeal to high-net-worth individuals create a strong foundation for long-term value.

The combination of rate cuts stimulating near-term demand, structural supply constraints, and Noosa’s unique position in the Australian property landscape suggests continued strength in our premium market segment, even as affordability challenges persist in the broader market.

The team at Reed & Co. are committed to helping you navigate these complex market conditions with informed, forward-looking strategies tailored to your specific property goals.

Please don’t hesitate to reach out if you’d like to discuss how these trends might affect your individual circumstances or if you’re considering changes to your property portfolio.