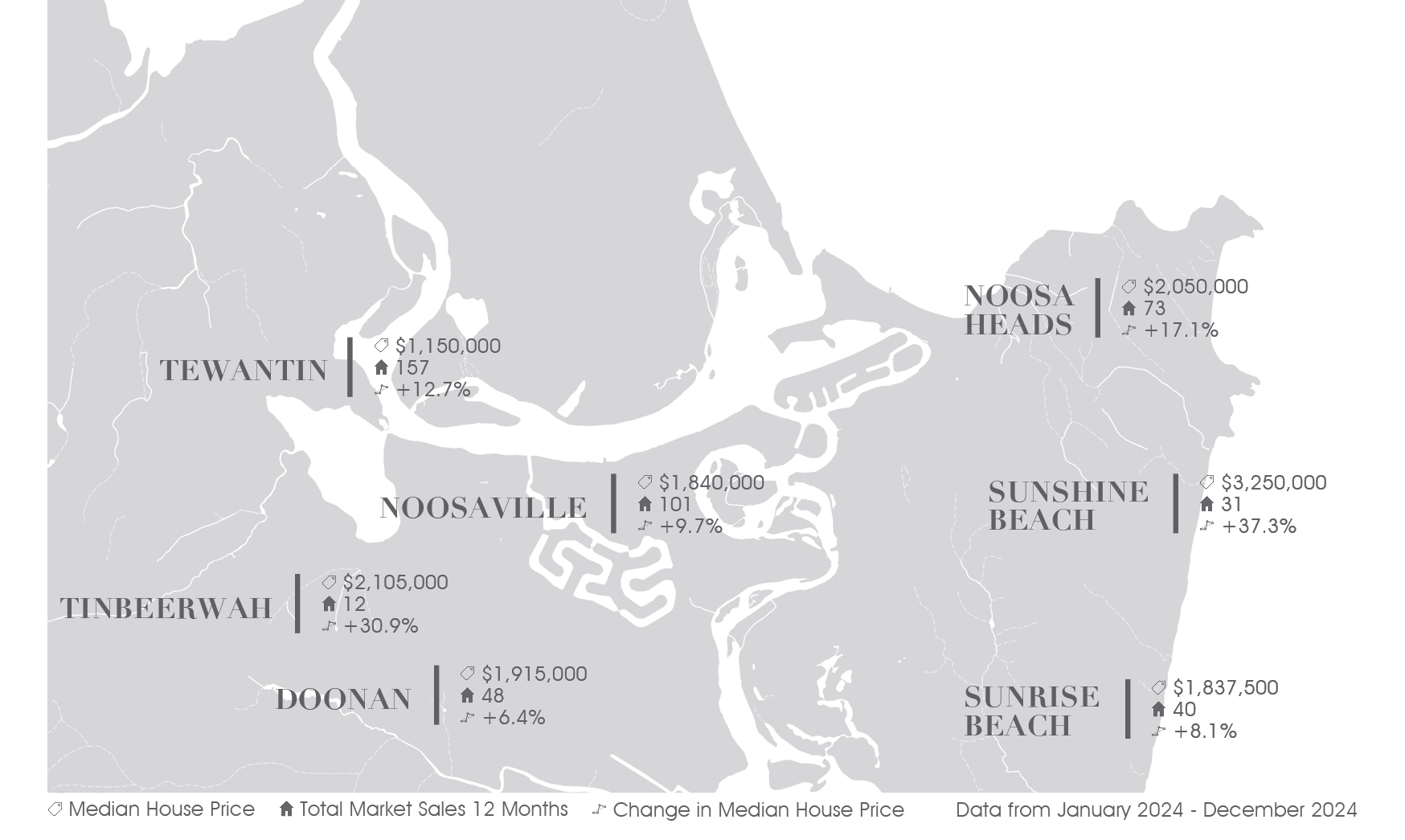

The 2024 property market concluded on a balanced and stable note, providing a fair environment for both buyers and sellers. This year’s spring market reflected typical seasonal activity, with our auction success rates consistently between 50% and 60%. This stability allowed vendors to sell with confidence whilst giving buyers an opportunity to enter the market without facing the extreme competition of boom conditions. While most capital cities experienced a retraction over the past year, Noosa has remained largely resilient holding onto the post COVID gains that have underwritten values for 2024. Noosa remains one of the most remarkable property markets in the country, with a 10-year growth in medium house values up 166% vs 70.4% for Sydney, 90% for Brisbane and a sobering 49% for Melbourne.

Standout properties continued to attract strong demand, including on the Waterfront Noosa Sound and Noosa Waters, Beachfront and Hinterland all achieving marque sales throughout the year. The increase in construction and trade costs has transformed buyer preferences, with many now prioritising complete properties ready to move into over homes requiring renovation work. With steady market conditions and growing confidence from both vendors and prospective buyers, the outlook for 2025 remains positive, suggesting stable growth ahead for our region.

“Looking ahead, I anticipate 2025 likely to be very similar to 2024, particularly in the

first half of the year.”

– Adrian Reed – Director & Founder, Reed & Co. Estate Agents

The market is expected to remain stable, the only speedbump is likely to be a short period either side of the Federal election as we wait for certainty to kick back in. Sustained population growth, driven by inbound Interstate migration and as well as a concentration of buyers moving from Brisbane competing for limited housing supply will continue to drive demand for Noosa property.

The government’s role in fostering a healthy property market cannot be overlooked. The recent change in state government has already stimulated confidence, bringing with it a spur in activity and enquiries that had otherwise softened by late last year. If there is a change in government at the next Federal election, which could happen as early as May, it is likely to boost the market further in the second half of 2025.

Interest rates continue to be a major topic of concern and while I don’t foresee any rate cuts on the horizon early in the year, I would suggest that by mid-2025 there is likely to be some relief for property owners. If rates are lowered, it will help alleviate financial pressure, allowing more buyers and homeowners to navigate the market with more confidence. This shift is expected to boost confidence and encourage increased activity in the market. Overall, whilst conditions may not change dramatically, the market is likely to maintain the current steady demand for quality properties and interest in rural lifestyle investments will also continue. With resilient buyer interest and a stable outlook, there are plenty of opportunities for growth and success in 2025.

Our agents are area experts, offering years of experience and in-depth knowledge, so if you are thinking of buying or selling, why not take advantage of our specialised advice. Click on the suburb below for a more detailed micro-market report, prepared by our agents specially for you.