Adrian Reed 31st March 2020

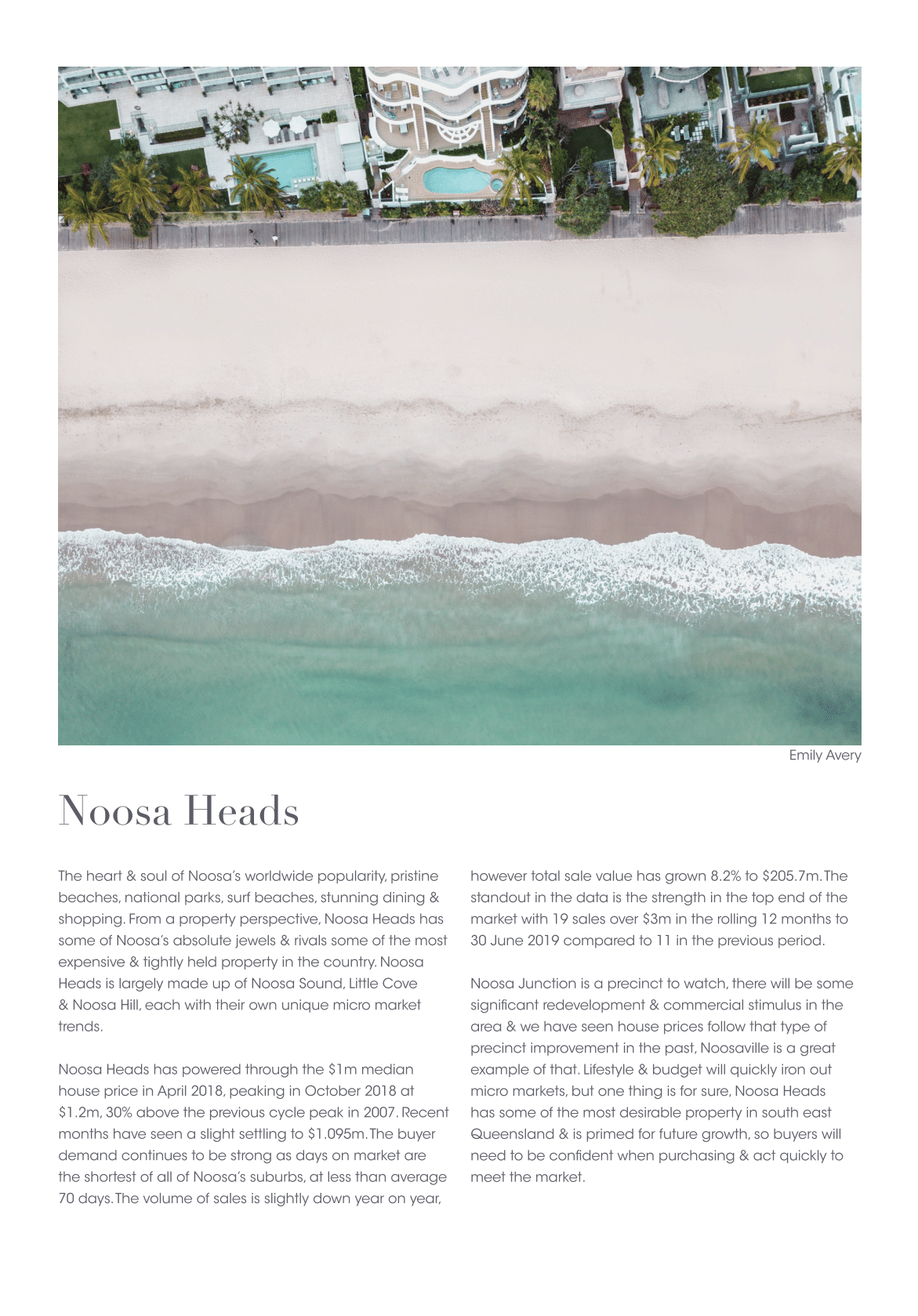

We’re here to help you navigate the excess of information and understand the main state of Noosa’s property market. Below are the crucial realities learned from us and other property-related businesses that are at the forefront of the changes taking place.

Fear and uncertainty rule at the moment

No one really knows what the impact on residential property markets will be although there has been plenty of commentary out there. Our advice to sellers is to be patient as the past week has proven there are genuine buyers in the market looking for housing solutions. If your property is a fit then we will see the activity on it.

For buyers there will be “seller motivation” that surfaces during the coming months, we have seen wholesale job losses across the tourism and hospitality industry Noosa’s largest commercial sector. Price discounting is likely to be seen in the $800k – $2m price range, there could also be movement of secondary homes and holiday/investment properties. Equally, it is also undeniable that stimulus and low-interest rates will prime real estate markets and when the turnaround happens it could be fast and it could catch a lot of buyers off guard as the market recovers.

Virtual Inspections and the new world order

One observation in the past week is that Reed & Co. share of listings has jumped vs our competitors; vendors perhaps siding with an agent who can deliver innovative solutions in a world demanding innovation, technology and a lot of energy. In previous downturns, there was a flight to experience and older, more established agents but this time around there will be a movement towards agents who can do more with less – the customer will be the ultimate beneficiary of this.

Whilst technology will come in to play over the coming months, there will always be an underlying need for people to physically inspect a property they intend to live or invest in.

My belief is that video marketing will continue to rapidly improve, become more factually based and will become more commonplace as the market adapts. As for inspections, I think people will wait until it is safe again before going too far down the “virtual inspection” path and uptake on this front might be different from agent to agent for now and probably depends more on the buyer profile than the price point of the property. Live, 360-degree virtual inspections are the best solution we have seen so far, tech that Reed & Co. developed and implemented last week.

Perspectives on Change

I have summarised some brief learnings from conversations with those in property-related businesses this week:

Finance Broker

Residential Lawyer

Property Developer

Buyers

Marketing / Advertising

Property Managers

Core Logic 17th March 2020 | 30 March 2020

Amid the spread of coronavirus, the past few weeks have seen increased expectations of an Australian recession, a slowdown in business activity and trillions of dollars wiped off global share markets. It has many asking what the impact of the coronavirus would be on Australian residential property.

This note explores fundamentals of housing to better understand outcomes in the current climate. It is found:

In beginning to assess the impact of the current slowdown on property, it is worth exploring how property has historically responded to negative economic shocks.

Major share market losses and recession are not necessarily predictors of declines in housing values. This can be seen in the figure below. When significant, negative economic shocks occur, the effect on the housing market varies. Property value changes depend on the level of impact on Australian industry.

As an example, the 1987 ‘Black Monday’ stock market crash was a negative shock, in which the Australian share market lost approximately 23% of its value in a single day.

But housing values were largely unaffected. By October of 1988, residential property values experienced double-digit growth, as financial deregulation contributed to asset value inflation.

In the 12 months to January 1988, the Australian unemployment rate declined 60 basis points. The Hawke government also reinstated negative gearing as we know it today, after temporarily quarantining any losses associated with rental property between 1985 and 1987. This may have provided an extra boost to Australian property investment at the time.

By the early 1990’s, Australia experienced a recession and property values declined, but only by -4.4%, from June 1989 to October 1990.

In 2007-08, when the GFC began, the Australian economy was more globalised. A slowdown in the global and domestic finance sector affected employment, incomes and subsequently borrowing capacity for housing.

The national dwelling market declined -7.5% from February 2008 to January 2009. However, an uplift in mining-related investment, the start of a rate cutting cycle and government stimulus saw a fairly swift recovery.

Recently, values been more reactive to structural changes in the lending space. Between 2014 and 2017, a series of policies limiting investment housing lending catalysed one of the largest and longest property market downturns since the early 1980’s. However, further rate cuts and eased serviceability assessment prompted an owner-occupier led rebound.

Aggregate figures on the housing market suggest that the slowdown in economic activity from the coronavirus has not impacted housing markets in the same way as equities. This is nothing new. Historically, comparing the S&P ASX 200 index with the CoreLogic home value index, suggests that property responds to macroeconomic conditions at a lag, and avoids the same extent of decline or volatility.

There are a couple of reasons for this:

The latter point is a particularly insulating factor at the moment. Since the start of the property market upswing in June 2019, investors comprised 28.2% of the new finance taken out to buy property. This is down from 39.5% in the previous upswing.

In other words, the retreat of investors from residential property will not have as large an impact as it would have two years ago.

The relatively low levels of foreign interest in the Australian dwelling market over 2019 also means there is less risk to the market from declines in this buyer group. According to the latest NAB residential property survey, foreign buyers in the December quarter of 2019 made up 7.0% of new property purchases (down from the survey average of 10.2%), and 3.8% of established property (down from the survey average of 6.1%).

Some will be exposed to a downturn in international market participants from travel bans. These include new unit projects targeting foreign buyers, and landlords who are reliant on foreign students or tourists for rental occupancy.

Property is not completely insulated from economic events. Depending on the extent of spread of coronavirus and institutional responses, reduced business activity could materially slow the flow of income and credit. This would have significant impacts for the property market.

Property transaction volumes are likely to fall in the coming months, but the outcome for values depends on temporal expectations around coronavirus, and longer-term employment conditions.

In the short term, the coronavirus and subsequent share market declines have already had a significant impact on consumer confidence. This may lead to postponed dwelling purchases, as housing is an expensive, high commitment purchase decision.

The Westpac-Melbourne Institute Consumer Sentiment Index declined -3.8% over March to a 5 year low, and recorded the second lowest reading since the GFC. The index is still 15.3% higher than the level at which it bottomed out in 2008, suggesting consumers are less worried about the economy than at the GFC.

Interestingly, the ‘time to buy a dwelling’ index component only fell -0.3% in March, but declines may soon deepen. The ‘house price expectations’ sub index fell more sharply, down 6.6% in March. This was the largest fall since February last year.

A more direct impact on transactions could be the rise of isolation precautions. If Australian governments follow quarantine measures enforced in Italy and China, then inter-city travel would be restricted, and confinement to the home would prevent physical inspections and on-site auctions.

While this may seem extreme, it is not unlikely: Victoria and the ACT have declared a state of emergency across the regions, increasing power of health ministers to enforce self-isolation.

This presents a challenge to the real estate sector, which often necessitates physical inspection of property and, in the case of auctions, bidding environments involving groups of people.

Real estate industry professionals may respond by offering private inspections rather than open homes, virtual inspections using technology, or remote auctions. But such technologies can be difficult to adopt in the best economic conditions. Prospective buyers and sellers are likely to postpone activity until conditions revert to normal.

Property values may not be impacted the same way. One important facet of the unfolding economic slowdown, is that it is led by institutional responses to the coronavirus pandemic. This is a unique cause for halting production and consumption.

Vendors may view the current pandemic as a temporary economic condition. If monetary and fiscal stimulus can adequately support business and household income amid the slowdown, then the next few months could see a sharp contraction in sales volumes, but not necessarily dwelling values.

This is because the expectation would be for market activities to return. Influenza periods for example, typically last 3-4 months. It is unclear whether coronavirus will be seasonal, but, after mass quarantines, China is now showing a slowed spread of the coronavirus. South Korea is also seeing a drop off in new reported cases after a social distancing campaign.

A comparison may be drawn with the high seasonality in sales volumes usually seen around annual holiday periods. Over the past two decades, the decline in sales volume activity from the month of November to December averaged -15.9%, and sales volumes in December have a seasonal factor of 0.9. By comparison, the past two decades have seen an average 0.2% uplift in values from November to December, with very little seasonality present.

While the current pandemic is by no means a holiday, it is temporary. Unless the current slowdown presents a significant drag on incomes, vendors may not see the need to lower their property value expectations.

In the long term, housing market values and activity will be linked to the extent that quarantine measures affect income, employment, borrowing capacity and credit availability.

The largest and most direct industry shocks from the coronavirus are expected in:

GDP growth in the March quarter was initially expected to be about 50 basis points lower from what it otherwise would have been. But research on the impact of past influenza pandemics suggests the losses may be greater.

Unlike the global financial crisis, where a mining boom, as well as monetary and fiscal policy were effective in helping Australia avoid recession, the domestic economy now faces new challenges:

Just days after announcing its $17.6 billion stimulus package, the government is considering a second stimulus package.

On Monday the 16th, the council of financial regulators announced further supportive measures for credit availability, including the RBA preparing the start of quantitative easing, and APRA have announced the potential easing of regulatory requirements to support the flow of credit.

In an address on the 11th of March, the RBA was keen to emphasise that the virus is ultimately a temporary disruptor to business activity, and that eased monetary conditions and fiscal policy would help the economy to “bounce back quickly once the virus is contained”.

Importantly, Australia does not have ‘one’ housing market. While this note considers the residential market in aggregate for simplicity, economic downturns have certainly created more acute, localised declines in property, such as;

Given the idiosyncrasies of the current downturn, there are likely to be parts of Australia where housing demand, including rental demand, will fall more sharply than others.

These include areas where workers cannot perform their jobs remotely, and may have to sacrifice income if social distancing is enforced, where there is a high incidence of casual employment, and where there is a high concentration of employment in affected industries.

Looking at the concentration of the workforce in accommodation and food services for example, points to pressure on households in Sydney’s Inner West, which has the highest portion of workers employed in this sector by SA4 region (12.7% at November 2019).

The coronavirus outbreak clearly presents some downside risk for the Australian housing market, but ultimately, the impact remains highly uncertain. New information and policy responses are unfolding daily, making it impossible to provide a reasonable forecast of capital growth. Some added context however, is remembering the fundamentals of the property market, and idiosyncrasies of a pandemic-led downturn.

Property is less volatile and slower to respond to market shocks than equities, it is a consumption good and it is tied to fundamentals of employment opportunity and income growth. In the current climate, the Australian housing market is more insulated from foreign demand and investment speculation than it has been over previous years.

Transaction activity is likely to be impacted more than market values. As consumer confidence reduces, and labour markets are disrupted, more Australians are likely to put high commitment decisions on hold until there is more certainty around the economy, jobs and household finances.

Additionally, stimulus measures including emergency level monetary policy settings and a surge in fiscal spending should help to cushion the impact of reduced business activity, but a recession in the first half of 2020 still looks likely.

The current high level of household debt amplifies the risk of unemployment on housing market conditions. However, areas severely impacted by social distancing would be less resilient than others in rebounding from the coronavirus pandemic.

Our views and research on the market outcomes in relation to the coronavirus will continue to evolve as more information comes to light.

Published By – Eliza Owen Core Logic

The Daily Telegraph 24th March 2020 | 30 March 2020

What does COVID19 mean for the property market?

The Rametta family is among those taking their home to auction on the first weekend of social distancing requirements. Picture: Tim Carrafa

“This was despite continued changes to the COVID-19 situation, as well as people’s concerns about the economy. It is likely that the enormous levels of stimulus is helping the property market, keeping it more stable than some other sectors,” she said.

Ms Conisbee also pointed out that although we may be going through a health crisis, there is no shortage of money with interest rates now sitting at 0.25 per cent and banks “ready to lend”. All this, she said, had “dramatically changed” her view as to the outlook of the property market.

Daniel Galea Harcourts Auctioneer elbows the highest bidder at an auction in Melbourne at the weekend. Picture: Tim Carrafa

What the data says

According to CoreLogic figures, Melbourne, Australia’s busiest auction market, had a preliminary auction clearance rate of 62.7 per cent from 1317 properties last week, which was up from 55.1 per cent from 814 homes in the same week this time last year.

Sydney recorded a 64.4 per cent rate from 923 homes put under the hammer – that’s up from 52.1 per cent from 506 auctions during the corresponding week in 2019.

In Brisbane, the clearance rate was weaker at 34.9 per cent for 105 listings, however is was still an improvement on 2019 when the same week saw a 28.2 per cent clearance.

In fact, despite the escalating health crisis and economic fallout related to coronavirus, the week that was just happened to be the second-busiest for auction activity so far this year. CoreLogic counted 2539 homes taken to auction across the combined capital cities, returning a preliminary national auction clearance rate of 61.3 per cent which is substantially higher than a year ago when values were falling.

Property values appear to be holding their own over the past 28 days. Although the month’s figures show a snapshot of a market that was well aware of coronavirus, the data reflects a pre-shut down version of Australia where there was more confidence in the economy and jobs. Sydney saw a 1.5 per cent rise over the past four weeks while Melbourne moved up slightly with a 0.8 per cent gain and Brisbane’s change was minimal at 0.5 per cent.

REA chief economist Nerida Conisbee.

What happens next

Ms Conisbee added that although clearance rates aren’t always the best indicator of the market (as they primarily reflect the top end in Melbourne and Sydney), we would need to have to wait for solid search activity trends and pricing data before we could see how Australian property is faring amid COVID-19.

She said while the first round of the Government’s stimulus didn’t have a direct impact on property, it would support the economy therefore assisting the property market indirectly.

“At this stage, the biggest risk to property is rising unemployment and an increase in distressed sales.

The stimulus packages are making home loans cheaper, but will ideally minimise people becoming unemployed.

The border shutdown will impact foreign purchasers of Australian property and is likely to have some impact on the new homes market, however, offshore buyers have been a small component of the market since 2017,” she said in her summary.

“While there are a lot of people watching for prices to fall dramatically so that they can grab a bargain, at this stage, I don’t believe that will happen.”

Postponed dwelling purchases may be a likely option.

The short to long term story

Eliza Owen, head of Australian research with CoreLogic said while sales activity was likely to decline, what the actual impact on values would be is still unknown territory.

“In the short term, the coronavirus and subsequent share market declines have already had a significant impact on consumer confidence.

“This may lead to postponed dwelling purchases, as housing is an expensive, high commitment purchase decision,” she said.

“In the long term, housing market values and activity will be linked to the extent that quarantine measures affect income, employment, borrowing capacity and credit availability,” she added.

Ms Owen stressed that it is important to recognise that Australia does not have just “one” housing market, but many micro markets.

“Given the idiosyncrasies of the current downturn, there are likely to be parts of Australia where housing demand, including rental demand, will fall more sharply than others.

“These include areas where workers cannot perform their jobs remotely, and may have to sacrifice income if social distancing is enforced, where there is a high incidence of casual employment, and where there is a high concentration of employment in affected industries,” she added

Published By – The Daily Telegraph

Kristen Craze

The Urban Developer 23rd March 2020 | 30 March 2020

Australia’s housing market is inevitably being impacted by social distancing measures and the market’s weaker confidence due to the coronavirus pandemic, with preliminary clearance rates taking a hit this week, falling to 61.3 per cent across its combined capital cities.

Despite the escalating health crisis and related economic fallout, the weekend experienced the second busiest for auction activity to date this year. Figures show 2,539 homes were taken to auction across Australia’s combined capital cities.

The preliminary auction clearance rate of 61.3 per cent is up on a year ago when home values were falling, but the impact of Covid-19 has begun to be felt.

Corelogic described this week’s preliminary auction results as “marking a turning point in buyer and seller sentiment”, with withdrawal rates rising and vendors thinking twice about testing the market as buyers lose confidence or choose to avoid public gatherings.

Corelogic says it’s likely that the preliminary auction clearance rate of 61.3 per cent will revise down to below 60 per cent for the first time since mid-2019 as remaining results are collected.

In comparison, the previous week saw 2,274 homes taken to auction returning a preliminary auction clearance rate of 70.6 per cent, before revising down to a final clearance rate of 65.3 per cent.

To date, Corelogic says there is no evidence of “reduced housing values”, although notes that it is clear, transactional activity will be temporarily disrupted in the coming weeks and months.

“The extent of this disruption depends on how long it takes to contain the virus and for sentiment to recover,” the data house notes.

Speaking on the housing market, AMP economist Shane Oliver said that if the recession should last more than six months – with unemployment up to 10 per cent or more, house prices could collapse by up to 20 per cent in a worst case scenario.

While social distancing is likely to delay property transactions, Oliver said AMP’s base case is for a rise in unemployment to around 7.5 per cent.

“This is likely to drive a 5 per cent or so dip in prices ahead of a property market recovery into next year as the economy bounces back and pent up demand is unleashed again helped by ultra-low interest rates,” Oliver said.

On Friday, the federal budget was postponed until October, as Scott Morrison outlined that the pandemic is likely to remain a problem for at least six months.

Morrison’s $66 billion stimulus package, announced Sunday, dwarves the initial $17.5 billion economic stimulus package announced eleven days ago, in a bid to “cushion the economy” as Australia goes into social shut down.

The measures follow the Reserve Bank of Australia’s emergency cash rate cut to 0.25 per cent last week.

Canberra has also announced that both commercial and residential tenants struggling to pay rent, would receive assistance as part of the coronavirus stimulus package.

“To ensure that in hardship conditions, there would be relief that would be available, and ensuring that tenancy legislation is protecting those tenants over the next six months at least,” Morrison said on Friday.

“Everyone does have that role to play, and that will include landlords for people who are enduring real hardship.”

Morrison said that this work will be done by states and territories.

“And that work will be led by Western Australia, together with New South Wales, working with all other states and territories, to bring back some model to be applied in hardship cases.”

Thank you for your understanding as we navigate through this period together. In changing times we want to provide the same service to our clients and we are looking forward to showing you your dream home.